Financial reform seeks breakthrough

0 Comment(s)

0 Comment(s) Print

Print E-mail Beijing Review, May 7, 2012

E-mail Beijing Review, May 7, 2012

|

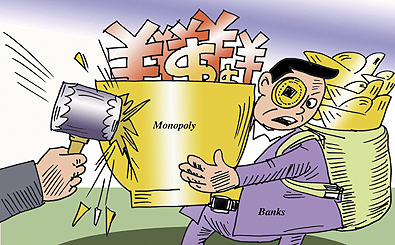

Policymakers hope new reforms will revitalize the slowing Chinese economy. The country's highly monopolized financial sector has become the first target of reform.

The major deficiency of China's current financial system is that the capital market is still monopolized by state-owned banks, but these banks are not able or willing to support small and medium-sized enterprises (SMEs) and emerging industries.

However, SMEs are one of the main forces in resolving employment problems, and also an important power in China's economic development. Emerging industries are the key industries to be developed in China's current economic transition.

To reform the financial sector, private investment potential should be fully utilized.

Today there is up to 4 trillion yuan ($634.9 billion) worth of private capital in the market, with most of it in the real estate sector, private lending, art and wine. If private lending is legalized and the capital is properly transferred into the real economy, speculative practices will be changed to investment practices, which will make it much easier for China's capital-hungry SMEs to get access to financial resources.

The financial reform will also deliver a message: the Central Government will no longer depend on monetary policies as much as it did in the past when dealing with problems in the real economy. It will try to resolve problems through financial reform, taxation reform and economic system reform.

It's not easy to push forward the reform. It must be based on a stable financial sector as well as stable and sound economic development. It's also necessary for decision-makers and reform participants to properly judge various problems emerging in the process of the financial reform and manage to solve the problems in a timely and flexible way.

Currently, two things should be taken into consideration. First, it's important to legalize private lending. While promoting private investments, it's necessary to first work out "game rules" for private investments. Second, China's financial sector not only needs to open private finance, but also needs a diversified financial market and interest rate liberalization.

Due to the consideration of economic security and stability, the financial reform that stems from Wenzhou in east China's Zhejiang Province, could be seen as a trial. Wenzhou is expected to set up a diversified financial system so as to greatly improve financial services and strengthen the ability to prevent and tackle financial risks. The region is supposed to provide experience to the rest of the country.

It's a pity that the liberalization of the interest rate and the establishment of private or joint-stock banks are not included in this round of reform. We hope that China's financial reform will be further pushed forward to ensure a successful transition of the Chinese economy.