Would Implementing QE3 Improve the Economic Environment?

- By Tylor Claggett

0 Comment(s)

0 Comment(s) Print

Print E-mail

China.org.cn, August 26, 2011

E-mail

China.org.cn, August 26, 2011

|

|

|

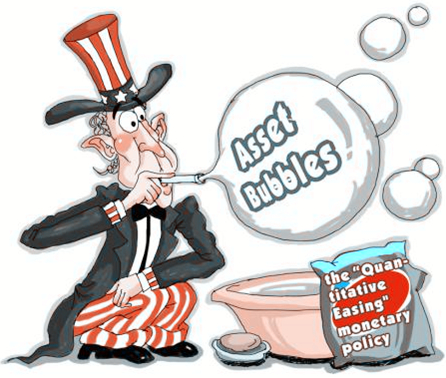

The Fed appears to be out of monetary policy tools to further stimulate the U.S. economy; save one: a possible QE3. [By Gao Wei/Xinhua?] |

There has been very little good economic news for the U.S. and the rest of the world lately, and plenty of bad news. To list just a few bad news stories, there have been supply chain interruptions caused by the Japanese earthquake, continued political unrest in the Arab world, the European sovereign debt crisis, and questions raised by the recent Chinese bullet train crash. The bad news on the U.S. domestic front includes continuing high unemployment, the troubled housing market, and high gasoline prices that siphon consumer spending and serve to foster inflation if sustained for any length of time. Adding to the confusion, stories such as unrest in the Middle East and higher gasoline prices are interrelated.

On top of this collection of concerns, there are all of the issues surrounding the fiscal conditions of the U.S., state and local governments. The U.S. government has failed to come up with significant, long-term remedies for pressing fiscal problems such as projected exponentially increasing expenditures for such programs as Social Security, Medicare, defense, and interest on the existing debt.

Recent equity market volatility and substantial sell-offs signal that capital markets are having trouble digesting and analyzing all of the bad news. Investors may need a "time out." Adding to investor worries is the deep sense the U.S. government is hopelessly deadlocked and unable to move on fiscal policy.

Rightly or wrongly, the burden of rescuing the U.S. economy has fallen largely on the U.S. Federal Reserve and the employment of monetary policy. A year ago, the Fed announced QE2, a bold plan to buy $600 billion of U.S. Treasury securities on the open market in an attempt to lower interest rates while putting more money into the economy. The hope was the plan would stimulate the U.S. economy and foster much needed economic growth and private sector job creation. QE2 has ended, and the hoped-for results have not materialized.

Recently, the Fed announced its plan to keep interest rates at record new lows through 2013; much to the chagrin of many. To make a long story short, the Fed appears to be out of monetary policy tools to further stimulate the U.S. economy; save one: a possible QE3. There has been much talk of such a possibility of late in the media. Unfortunately, to this author, it would be a "hail Mary pass" with a low probability of yielding any desirable results, but with a high probability of creating long-term difficulties. Here is why.

First, low interest rates for the past several years have not inspired businesses to expand investment, production or employment. In particular, large U.S. corporations have record levels of cash on hand; therefore, available funds and liquidity are not a problem. Furthermore, weakening the U.S. dollar by additional cash infusions only serves to lay the groundwork for higher commodity prices (especially for oil); thereby dramatically increasing the threat of rampant long-term general inflation. Investors the world over will further discount to value of securities denominated in U.S. dollars, making after QE3 interest rates in the U.S. much higher than otherwise.

The truth is QE2 and QE3 are programs that are tantamount to "printing money." And, if world history has taught us anything, it is that once a nation begins to print money without tangible underlying assets, it is very addictive and the political consequences of stopping are prohibitive. It seems the U.S. may already be "hooked."

The author is a columnist with China.org.cn. For more information please visit: http://www.shenbo75.com/opinion/tylorclaggett.htm

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn.