What does the S&P downgrade of US Treasuries mean?

|

|

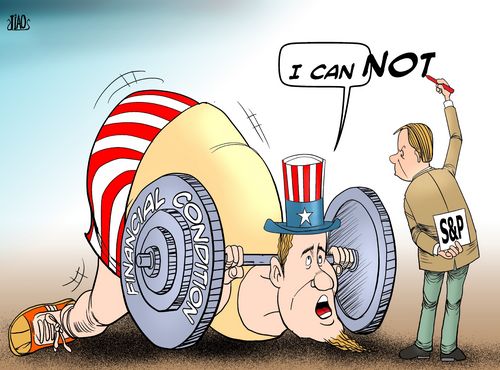

No longer up to scratch [By Jiao Haiyang/China.org.cn] |

On April 18, credit rating agency Standard & Poor's (S&P) downgraded its long-term outlook for US government debt from "stable" to "negative". The announcement sent equities and some other financial securities into sharp decline almost immediately. But the prices for US Treasury (UST) bonds remained mostly unchanged. And the nose dives that occurred were reversed within around 24 hours. In hindsight, it is important to coolly analyze what actually happened. Then maybe we can better comprehend the event's real effect on markets.

First, many news outlets reported or implied that US government debt securities carry an AAA bond rating. This is a little bit misleading, because investors have always put UST securities in a class by themselves. (If all else fails, the US government can always "print money" to pay the interest and principle, right?) There is much evidence to support this behavior.

Yield curves for AAA corporate bonds have always shown higher yields than for UST bonds with similar maturities. This is because investors worldwide feel the default risk for UST debt is significantly lower than for comparable AAA-rated corporate debt. Therefore, to suggest UST debt is in danger of losing its AAA bond rating is suspect, because it never had such a rating in the first place.

Most non-financial people do not know what a bond rating really means. Similarly, the phrase, "long-term outlook," is a little bit vague to those of us that are well versed in financial market jargon. Consequently, changing the description from "stable" to "negative" did not really provide any additional information to the public or to the markets. In capital markets all over the world, everyone knows the US debt level is unsustainable given the current US tax take and the level of US government spending.

It is true that Washington politics is worrying investors, mainly because of the looming debate over when and by how much to raise the US government debt ceiling. And there is also concern that a consensus on the 2012 US budget will be hard to come by. Both the short term debt ceiling issue and the medium term 2012 budget issue raise red flags for investors. But do these political nuances really change the fundamentals for investors when it comes to contemplating whether to invest in UST securities? Apparently they do not – as yet anyway.

Therefore, can we conclude that maybe S&P was grandstanding, or trying to send a message to the US Congress and President to deal with social promises like Medicare against a backdrop of lagging revenue collection and two (maybe three) foreign wars? If the latter were intended, I doubt the politicians in Washington got the message. Rest assured; the capital markets will do their own default risk analyses as events unfold. The S&P story was like yesterday's news paper – thrown away after being read.

But consider this. A one percent hike in the borrowing rate on the current $14.3 trillion of US debt would cost American tax payers $143 billion every year. So, it is important that the people in Washington pay attention to investor sentiments; whatever they may be.

The author is a columnist with China.org.cn. For more information please visit: http://www.shenbo75.com/opinion/node_7078635.htm

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn.

0

0