The influx of speculative money from overseas, or hot money, into China's stock market is showing signs of slowdown thanks to recent cooling-down measures by the government, analysts said.

The increase in foreign exchange reserves not attributed to trade surplus or foreign direct investment declined from US$73 billion in the first quarter to US$48 billion in the second quarter, according to data from investment bank Lehman Brothers and CEIC, an international financial information provider.

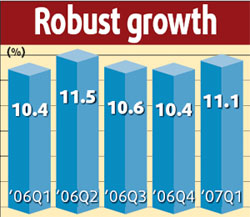

China registered a rise in foreign exchange reserves of US$131 billion in the second quarter. Despite its high percentage in annualized terms, the actual amount is less than the US$136 billion that China earned in the first quarter.

The change "suggests that hot money inflows may be slowing," Sun Mingchun, vice-president and Asia economist of Lehman Brothers Asia Ltd, told China Daily yesterday.

He attributed it to strict checks by the government on illegal capital inflows and slow trading in the equity market since the rise in the stamp tax on stock transactions in early June.

The hot money may now go to Hong Kong or other markets to seek better investment returns, Sun said.

In another development, the State Administration of Foreign Exchange (SAFE) repeated its call yesterday to control illegal capital inflows, or money going into the stock or real estate markets betting on the yuan's appreciation, under the pretext of trade payment or direct investment.

"The regulatory authorities will continuously strengthen monitoring and administration of cross-border flows of funds, and block the inflow of foreign capital on fictitious trade claims," said a statement posted on the SAFE website yesterday.

Sun of Lehman Brothers said that the government should publish the results of the investigations and penalize companies violating the regulations, "to prevent more companies from following suit".

(China Daily July 13, 2007)