| Home / Business / Finance | Tools: Save | Print | E-mail | Most Read | Comment |

| Cooling Shares Boost Savings |

| Adjust font size: |

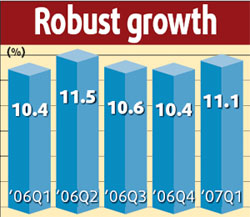

The rocky stock market has helped put a stop to fleeing bank savings in Shanghai. Household savings in Chinese financial institutions in the city increased by 6.09 billion yuan in June, according to the Shanghai head office of the People's Bank of China, the country's central bank. That was a contrast to a decrease of 25.89 billion yuan recorded in May, when stock prices continued to soar, as did the number of new accounts opened. Analysts said the rise in bank savings was largely due to the fading appeal of the stock market, which entered a stage of correction in June after the central government began various measures to cool the market. New accounts opened by Chinese investors in the A-share market have plunged from about 300,000 a day a month ago to a current daily count of fewer than 100,000. According to the central bank report, bank savings continued to be withdrawn and invested in other sectors beginning in the second half of last year, but the trend was reversed in June. More than 70 billion yuan in bank savings in Shanghai was diverted to the capital market in the first four months of this year, according to previous central bank reports. A 25.89 billion yuan decrease in bank deposits in May was the biggest monthly drop since January 1999. In addition to household savings, corporate deposits in Chinese financial institutions in Shanghai also grew 66.12 billion yuan in June. The report from the central bank's Shanghai office said there have been drastic changes in current corporate deposits in the first half of the year, reflecting fluctuations in the stock market. While the drain on savings has slowed, the reviving property market in the city might become a new concern for local banks. Housing prices in Shanghai have started to rise again over the last few months. Home loans issued by the city's domestic financial institutions chalked up a 4.55 billion yuan increase in June, some 3.69 billion yuan over May and two-thirds of the total increase for the first half of the year. Housing loans in Shanghai started to decline in July 2005 after the central government announced measures to cool the property market. (China Daily July 11 2007) |

| Tools: Save | Print | E-mail | Most Read |

| Comment | |||

|

|

| Related Stories |

|

|