Millionaires club expands in China

The global economic downturn has not affected the personal wealth of the rich in China that continued to expand this year and also opened up more opportunities for private bankers, said a recent study.

|

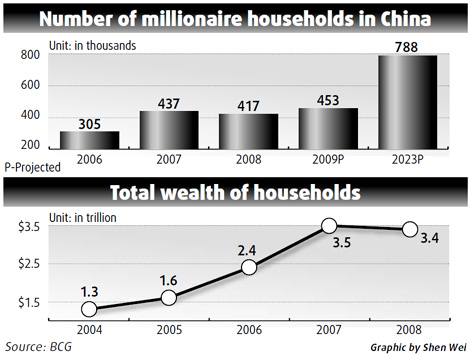

The number of millionaires with personal holdings in excess of $1 million is expected to cross 450,000 by the end of the year, with assets under management hitting $1.73 trillion, surpassing the country's pre-crisis levels, said the report released by Boston Consulting Group (BCG) yesterday.

That compared with a prolonged recovery in the global wealth market, with BCG predicting that a return to 2007 levels globally would take at least four years. Global wealth suffered the first decline in eight years in 2008, dropping 11.7 percent to $92.4 trillion.

"China is arguably the most explosive wealth market in the world, as rising income and a high savings rate will continue to spur development," Frankie Leung, partner and managing director of BCG Greater China and one of the primary authors of the report, said.

He expected the number of millionaires in China to reach 800,000 over the next four years.

However, China's wealth market was not immune to the financial crisis. Wealth in the country fell by 2.3 percent to $3.41 trillion last year, as the country witnessed volatile stock markets, plunging exports and fluctuating property prices throughout the crisis.

The study also showed the country's wealth was very much concentrated in certain individual groups and regions. Millionaire households represented only about 0.1 percent of all households in China, but held nearly half of the total wealth. Most of them are located in Guangdong, Beijing, Shanghai and other coastal provinces.

With the swelling personal wealth in China, the battle for high net worth clients between foreign and local banks has also intensified. Foreign banking giants, including HSBC, Citibank and BNP Paribas, have all set up private banking operations in the country since 2007.

The global movement from west to east and from north to south is expected to accelerate after the financial crisis, bringing unparalleled business growth opportunities to companies that have presence in emerging markets, Hans-Paul Burkner, global CEO of BCG told China Daily in an interview.

Local banks also stepped up their efforts to expand their geographic footprint. Bank of China, the nation's third largest lender by market value and the first Chinese bank to launch private banking business, has established private banking centers in 15 regions and strengthened its overseas private banking capacity through the acquisition of Geneva-based Heritage Fund Management in 2008.

Its rival Industrial and Commercial Bank of China, the nation's largest bank by assets and retail network, announced on Wednesday that it would soon expand its private banking network from the current five cities to 10, to cover other economic regions like Yangtze River Delta, Pearl River Delta and central China.

"No bank has emerged as a dominant leader so far, but local banks still dominate the market in terms of customer numbers and assets under management, thanks to their retail networks and sizable customer bases," Leung said.

0 Comments

0 Comments