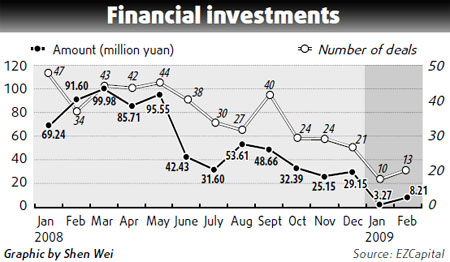

Investments by venture capital (VC) and private equity (PE) funds declined by 99 percent year-on-year in the first two months of this year, a report by the Beijing-based consulting firm Eternal Zenith Capital has revealed.

These funds invested a total of 1.15 billion yuan in 23 companies in the past two months. In the corresponding period last year, 81 companies received 160.84 billion yuan from VC and PE sources, the report showed.

However, strategic investment in Chinese companies bucked the trend. During the first two months of this year, 14 Chinese companies got 14.87 billion yuan in strategic investment, up 22 percent year-on-year, the report pointed out.

"Actually, strategic investment began to increase from end of last year, as industry heavyweights, which seek long-term development, were less affected by the economic cycle," Eternal Zenith Capital's analyst Hua Jing said.

The report also noted that mergers and acquisition (M&A) activity flourished in the first two months of the year.

There were 46 M&A transactions totaling 35.8 billion yuan during the first two months, a four-fold increase over the same period last year, it said.

The first quarter is usually a quiet season for investment activity as companies take a break from capital raising. Only four investment institutions have set up new funds in January, raising about 7.02 billion yuan, the report showed.

The IPO market has remained sluggish since September of last year. In the first two months of this year, only eight companies went public, raising a combined 1.78 billion yuan.

Among these companies, one was listed on the A-share market, five went public in Hong Kong and two in New York.

The report also revealed that mezzanine capital funds, which provide interim investment to companies, got more opportunities to invest this year as companies found it hard to raise capital through initial public offerings or debt.

(China Daily March 6, 2009)